Interview About Appraisals with Anthony Young from Valued Audit

This interview is with Anthony Young with Valued Audit. Anthony is a San Francisco Bay Area appraiser. Anthony has amassed over two decades of experience as a leader in the appraisal industry, garnering a wealth of knowledge in the field. Over the course of his tenure, he has navigated various valuation challenges, from evaluating multi-million dollar properties owned by Hall of Fame rockstars to facilitating the appraisal process for tens of thousands of individuals. Anthony’s reputation as a nationally renowned speaker and educator on an expansive range of topics within the appraisal industry is well-established. He has developed numerous courses aimed at equipping individuals with a comprehensive understanding of the appraisal process.

Learn more and to contact Anthony with the links below:

https://www.instagram.com/valuedaudit_homeappraisals/

https://www.facebook.com/ValuedAudit

https://www.linkedin.com/in/professionalappraiser/

Don’t forget to learn more about me at the following online locations. Please Like and Subscribe:

https://www.facebook.com/DavidSciplinRE

https://youtube.com/@davidsciplin360

https://www.instagram.com/davidsciplin/

David Sciplin’s with Bryan Russell from First Bank

In this video, David sits down with Bryan Russel with First Bank. Bryan discusses how he takes care of his clients by offering excellent service.

Don’t forget to learn more about me at the following online locations. Please Like and Subscribe:

https://www.facebook.com/DavidSciplinRE

2024 California Economic & Housing Market Forecast

2024 California Economic & Housing Market Forecast

September 21, 2023

Jordan G. Levine

Senior Vice President & Chief Economist

California Association of Realtors

David Sciplin’s Interview with Esther Chien from the Loan Story

This is an interview with Esther Chien from the Loan Story.

Esther talks about the interesting meaning behind the company’s name. Esther also talks about critical next on Condo buying.

The U.S. is short 4.5 to 5 million homes, says Re/Max CEO Nick Bailey on housing demand

WED, DEC 27 20235:30 PM EST

Nick Bailey, Re/Max CEO, joins ‘Closing Bell Overtime’ to talk housing prices, the state of the real estate market, what’s ahead for 2024 and more.

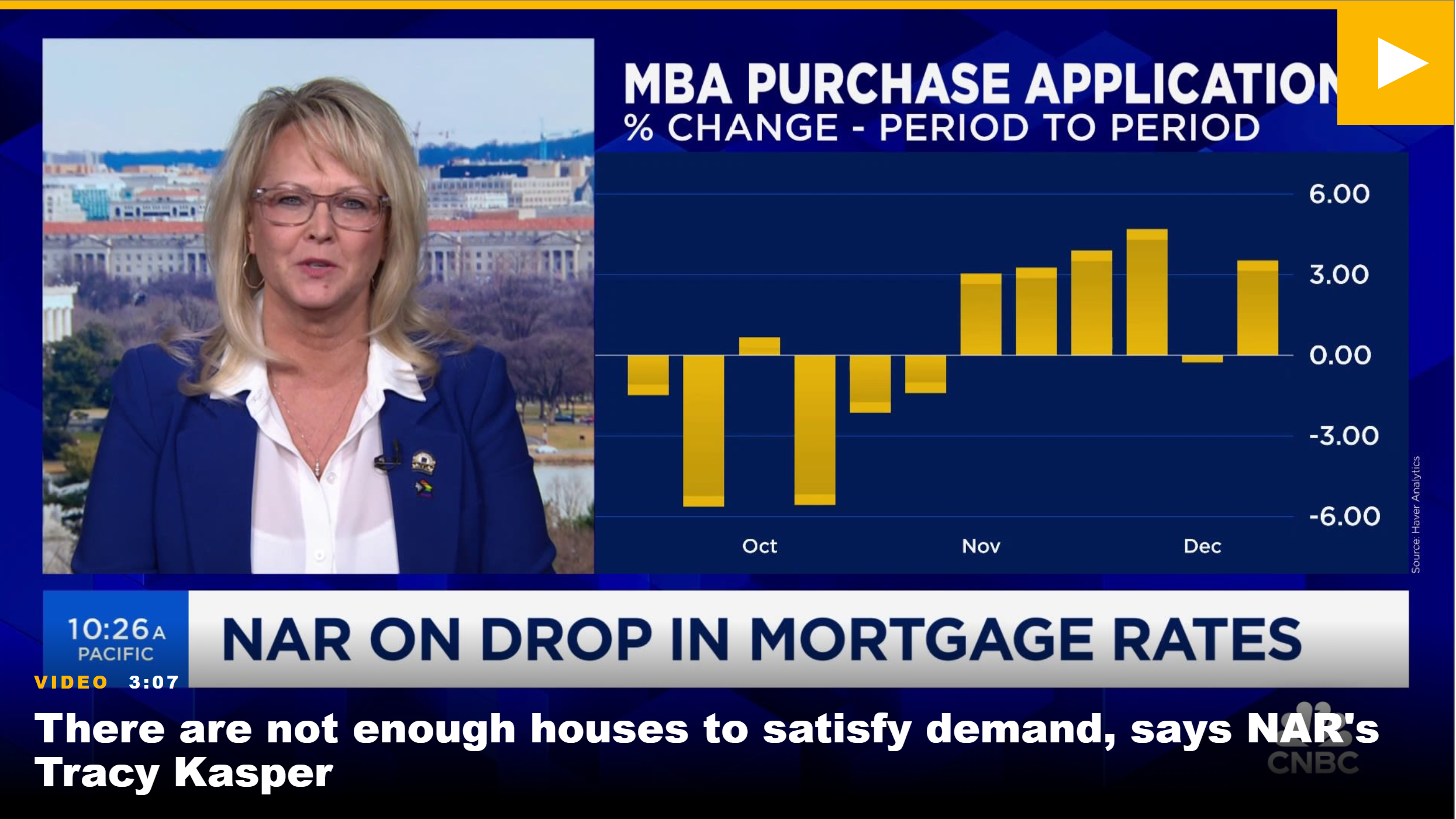

There are not enough houses to satisfy demand, says NAR’s Tracy Kasper

THU, DEC 14 20232:02 PM EST

Tracy Kasper, president of the National Association of Realtors, joins ‘The Exchange’ to discuss the housing market’s outlook for 2024, the drop in mortgage rates, and more.

Why Mortgage Rates Could Continue To Decline

Why Mortgage Rates Could Continue To Decline

When you read about the housing market, you’ll probably come across some information about inflation or recent decisions made by the Federal Reserve (the Fed). But how do those two things impact you and your homebuying plans? Here’s what you need to know.

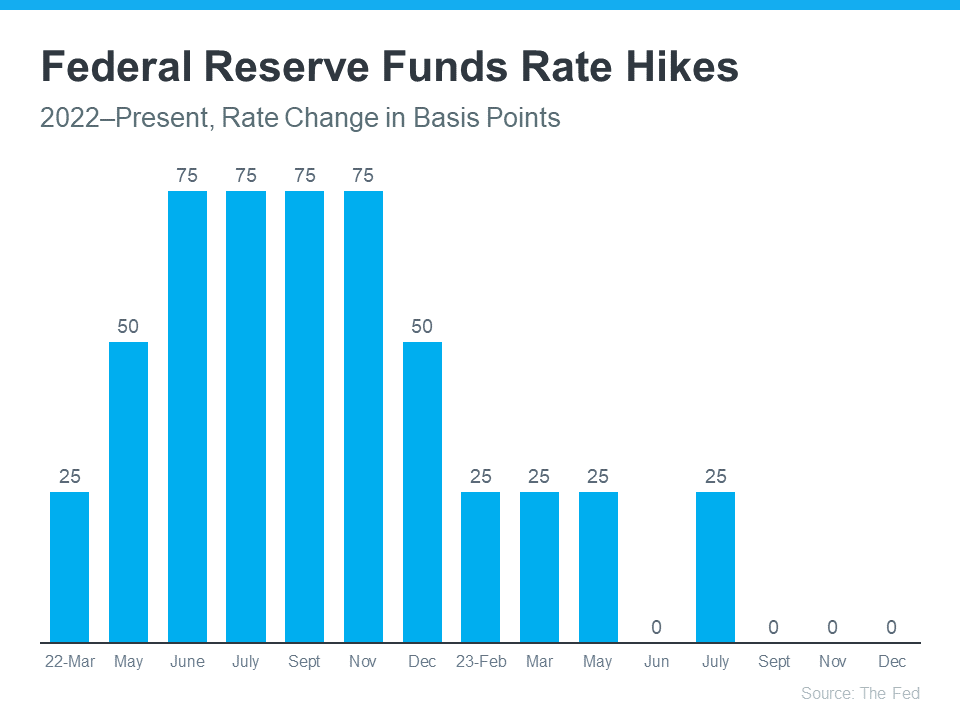

The Federal Funds Rate Hikes Have Stalled

One of the Fed’s primary goals is to lower inflation. In order to do that, they started raising the Federal Funds Rate to slow down the economy. Even though this doesn’t directly dictate what happens with mortgage rates, it does have an impact.

Recently inflation has started to cool, a signal those increases worked and are bringing inflation back down. As a result, the Fed’s hikes have gotten smaller and less frequent. In fact, there haven’t been any increases since July (see graph below):

And not only has the Fed decided not to raise the Federal Funds Rate the last three times the committee met, they’ve signaled there may actually be rate cuts coming in 2024. According to the New York Times (NYT):

“Federal Reserve officials left interest rates unchanged in their final policy decision of 2023 and forecast that they will cut borrowing costs three times in the coming year, a sign that the central bank is shifting toward the next phase in its fight against rapid inflation.”

This indicates the Fed thinks the economy and inflation are improving. Why does that matter to you and your plans to buy a home? It could end up leading to lower mortgage rates and improved affordability.

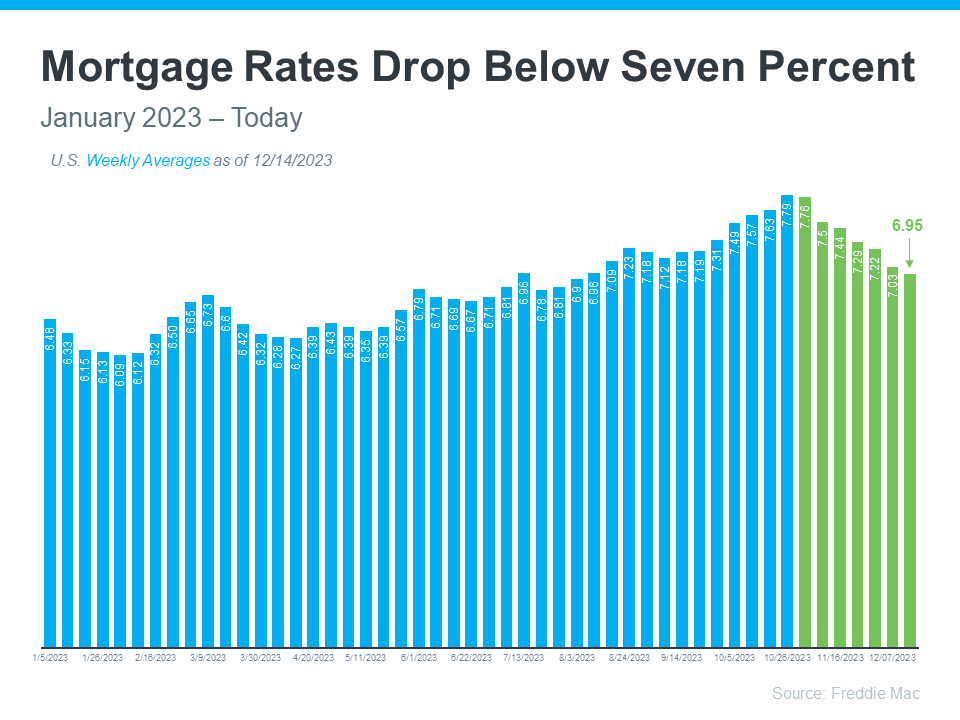

Mortgage Rates Are Coming Down

Mortgage rates are influenced by a wide variety of factors, and inflation and the Fed’s actions (or as has been the case recently, inaction) play a big role. Now that the Fed has paused the increases, it looks more likely mortgage rates will continue their downward trend (see graph below):

Although mortgage rates may remain volatile, their recent trend combined with expert forecasts indicate they could continue to go down in 2024. That would improve affordability for buyers and make it easier for sellers to move since they won’t feel as locked-in to their current, low mortgage rate.

Bottom Line

The Fed’s decisions have an indirect impact on mortgage rates. By not raising the Federal Funds Rate, mortgage rates are likely to continue declining. Let’s connect so you have expert advice about changes in the housing market and how they affect you.

Crockpot Holiday Wassail

Another 2011 post from my old website.

Here is the recipe for a holiday Mix-A-Drink

Ingredients:

1 qt. apple juice

1 qt. orange juice

2 c. cranberry juice

2 tsp. lemon juice

1 can pineapple nectar

1 cup sugar

3-4 cinnamon sticks

8 whole allspice

1 orange, thinly sliced

Directions:

Combine all ingredients in Crockpot (4 qt. or larger) and cook on low setting for about 4 hours or until heated to desired temperature. To save time, you may also cook it on high initially for an hour and then reduce the heat. This reheats well for 3 days.

From December 2011 Between Friends Newsletter, courtesy of Old Republic Home Warranty

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link